Understanding Pocket Option Commission: A Comprehensive Guide

When it comes to the world of online trading, especially within options trading, the term Pocket Option Commission often surfaces as a crucial component that traders need to understand. Whether you’re a novice or an experienced trader, comprehending commission structures can significantly enhance your trading strategy and profitability. In this guide, we aim to give you a detailed overview of what Pocket Option Commission entails and how you can navigate it effectively.

What is Pocket Option?

Pocket Option is a relatively new but rapidly growing online trading platform specializing in binary options trading. It has gained popularity due to its user-friendly interface, wide range of trading assets, and competitive features tailored to both beginners and seasoned traders. However, as with any trading platform, understanding its cost structure, including commissions, is vital to optimizing your trading performance.

Understanding Commission in Trading Platforms

In trading, a commission is essentially a fee that a broker or trading platform charges you for executing your trades. It serves as a primary source of revenue for these platforms and can have various structures, such as flat fees, percentage-based fees, or a combination of both. Understanding these fees is crucial as they directly impact your trading costs and potential returns.

Pocket Option Commission Structure

Pocket Option boasts one of the most straightforward and trader-friendly commission structures in the industry. Unlike many trading platforms that charge complex and hidden fees, Pocket Option aims to provide transparency to its users. Here’s a breakdown of their commission structure:

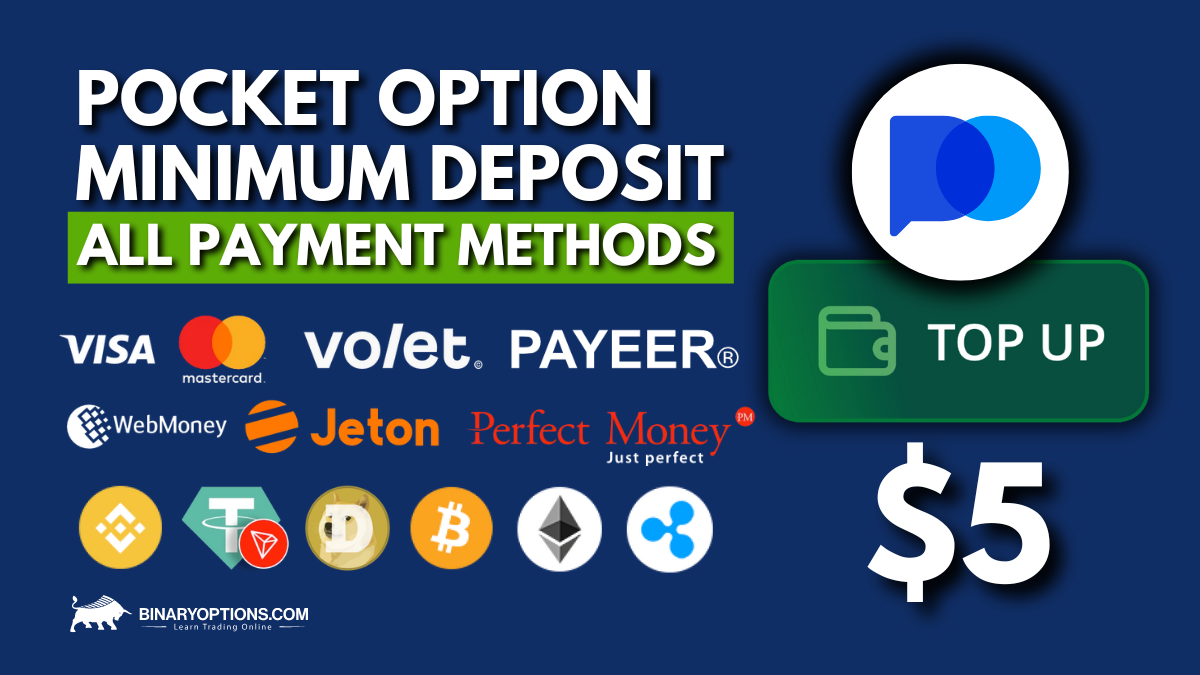

- No Deposit or Withdrawal Fees: Pocket Option does not charge users for depositing or withdrawing funds, making it easier for traders to move their capital without incurring extra costs.

- Competitive Trading Costs: While Pocket Option does charge a commission on trades, these costs are often competitive compared to industry standards, helping traders retain more of their earnings.

- Clear and Transparent Fees: All fees associated with trading on Pocket Option are clearly outlined before you execute a trade, allowing for greater cost management and planning.

How to Minimize Commission Costs

As a trader, minimizing unnecessary costs such as commissions is key to maximizing profitability. Here are some strategies to help you reduce commission-related expenses on Pocket Option:

- Choose the Right Account Type: Pocket Option offers various account types, some of which may come with reduced commission rates. Carefully evaluate each option to find the best fit for your trading style.

- Plan Your Trades: By planning your trades and focusing on quality over quantity, you can reduce the overall number of trades executed, thereby cutting down on cumulative commission costs.

- Leverage Bonus Opportunities: Pocket Option often offers bonuses and promotional campaigns which can offset trading costs and provide additional value.

The Impact of Commission on Trading Strategy

Understanding how commission fees affect your trading strategy is critical. High commission fees can eat into your profits, especially when dealing with low-margin trades. Here’s how Pocket Option’s commission structure supports different trading strategies:

- Scalping and Day Trading: Traders who employ these strategies benefit from the low commission fees, as they rely on executing a high volume of trades with small profit margins.

- Swing and Position Trading: While these strategies involve fewer trades over longer periods, the competitive commission rates help preserve profit margins.

Conclusion

The Pocket Option Commission structure is designed to favor traders by minimizing costs wherever possible, thus potentially enhancing your trading experience. By understanding and strategically planning around these commissions, traders can better manage their expenses and improve their trading outcomes. Whether you’re just starting or looking to refine your existing trading strategies, keeping an eye on commission costs will undoubtedly contribute to your success on the Pocket Option platform.

Final Thoughts

While commissions are an inevitable part of trading, choosing a platform like Pocket Option that offers transparent and competitive rates can make a significant difference. Remember to continuously review your trading costs and adjust your strategies as needed to ensure that you’re maximizing your potential returns without being hampered by excessive fees. Happy trading!