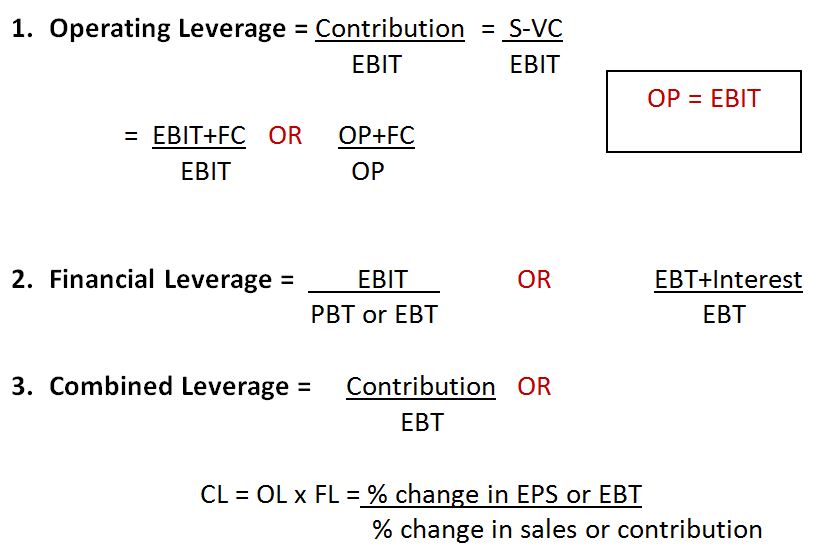

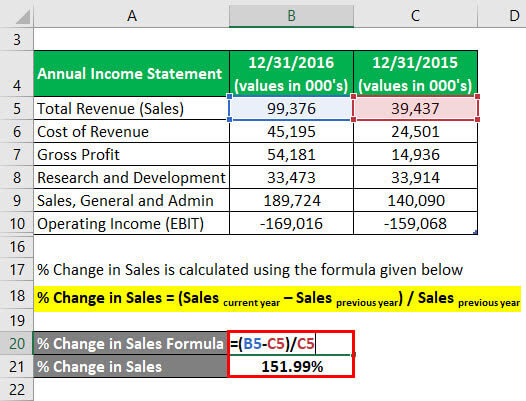

Consider, for instance, fixed and variable costs, which are critical inputs for understanding operating leverage. It would be surprising if companies didn’t have this kind of information on cost structure, but companies are not required to disclose such information in published accounts. A measure of this leverage effect is referred to as the degree of operating leverage (DOL), which shows the extent to which operating profits change as sales volume changes. This indicates the expected response in profits if sales volumes change.

- Sales growth is far and away from the biggest driver of operating leverage and growth of the company.

- Managers need to monitor DOL to adjust the firm’s pricing structure towards higher sales volumes as a small decrease in sales can lead to a dramatic decrease in profits.

- Later on, the vast majority of expenses are going to be maintenance-related (i.e., replacements and minor updates) because the core infrastructure has already been set up.

- For example, as a base rate, most companies in the U.S. will grow at least at the rate of the economy or GDP, which historically ranges between three to four percent.

Fundamental Business Principles (That Make Millions)

In this example, the company’s operating leverage is 2, which means that for every 1% increase in sales revenue, the operating income will increase by 2%. Understanding operating leverage helps businesses assess their risk, break-even point, and potential for profitability in response to changes in sales volume. The degree of operating leverage calculator is a tool that calculates a multiple that rates how much income can change as a consequence of a change in sales. In this article, we will learn more about what operating leverage is, its formula, and how to calculate the degree of operating leverage.

What Is a Good Leverage Ratio?

Because Walmart sells a huge volume of items and pays upfront for each unit it sells, its cost of goods sold increases as sales increase. Operating leverage is a cost-accounting formula (a financial ratio) that measures the degree to which a firm or project can increase operating income by increasing revenue. A business that generates sales with a high gross margin and low variable costs has high operating leverage. A high degree of operating leverage indicates that the majority of your expenses are fixed expenses. Though high leverage is often viewed favorably, it can be more difficult to reach a break-even point and ultimately generate profit because fixed costs remain the same whether sales increase or decrease. This means that the more fixed costs that a company has, the more sales it has to generate to earn a profit.

Get in Touch With a Financial Advisor

Other costs included are non-cash items such as depreciation and amortization and stock-based compensation, which the company uses to reduce earnings, even though actual cash doesn’t flow out for those expenses. Another benefit to studying operating leverage is seeing management efficiency in action, better management in controlling costs, and focusing on efficiencies across the board will lead to better results. However, the risk from high operating leverage also depends on the company’s overall Operating Margins.

Microsoft or Apple is a perfect example of a high-leverage operating business. If you have the percentual change (period to period) of EBIT, put it here. Finally, it is essential to have a broad understanding of the business and its financial performance. That’s why we highly recommend you check out our otherfinancial calculators.

This leverage ratio attempts to highlight cash flow relative to interest owed on long-term liabilities. This ratio indicates that the higher the degree of financial leverage, the more volatile earnings will be. Since interest is usually a fixed expense, leverage magnifies returns and EPS. This is good when operating income is rising, but it can be a problem when operating income is under pressure. The level of scrutiny paid to leverage ratios has increased since the Great Recession of 2007 to 2009, when banks that were “too big to fail” were a calling card to make banks more solvent.

It is important to understand that all costs are variable in the long run; separating between fixed and variable is a good practice and great to understand. But when companies experience downturns, such as in March 2020, many will have the ability to reduce both fixed and variable costs in response. High operating leverage increases the volatility of earnings and the risk of losses during sales declines. It reduces flexibility and makes the business more vulnerable to economic cycles. Once obtained, the way to interpret it is by finding out how many times EBIT will be higher or lower as sales will increase or decrease respectively. For example, for an operating leverage factor equal to 5, it means that if sales increase by 10%, EBIT will increase by 50%.

In year one, the company’s operating expenses were $150,000, while in year two, the operating expenses were $175,000. Operating Leverage is controlled by purchasing or outsourcing some of the company’s processes or services instead of keeping it integral to the company. Another way to control this operational expense line item is to reduce unnecessary expenses, especially during slow seasons when sales are low. how twitter and facebook think they handled the election The only difference now is that the number of units sold is 5mm higher in the upside case and 5mm lower in the downside case. Companies with high DOLs have the potential to earn more profits on each incremental sale as the business scales. Later on, the vast majority of expenses are going to be maintenance-related (i.e., replacements and minor updates) because the core infrastructure has already been set up.

Companies with higher operating leverage carry higher fixed costs regardless of whether they do $1 of sales or millions. Low-operating leverage companies may have higher variable, fixed costs but lower fixed costs. A company’s operating leverage translates revenue growth into operating income, or EBIT (earnings before interest and taxes). And that leverage also translates into the volatility of the operating income or operations of the company.

Therefore, each marginal unit is sold at a lesser cost, creating the potential for greater profitability since fixed costs such as rent and utilities remain the same regardless of output. In practice, the formula most often used to calculate operating leverage tends to be dividing the change in operating income by the change in revenue. The more fixed costs there are, the more sales a company must generate in order to reach its break-even point, which is when a company’s revenue is equivalent to the sum of its total costs. That depends on the particular leverage ratio being used as well as the type of company. For example, capital-intensive industries rely more on debt than service-based firms, so they would expect to have more leverage. To gauge what is an acceptable level, look at leverage ratios across a certain industry.