They will work according to company policy, or in accordance with the laws that govern NPOs. Government accounting tracks the movement of money through a number of different agencies and makes sure that budgets are kept to or met. Internal auditing involves evaluating how a business divides up accounting duties. As well as who is authorized to do what accounting task and what procedures and policies are in place.

What are the different types of accounting methods?

A balance sheet reports a company’s financial position as of a specific date. It lists the company’s assets, liabilities, and equity, and the financial two types of accounting statement rolls over from one period to the next. Financial accounting guidance dictates how a company records cash, values assets, and reports debt.

Streamline your order-to-cash operations with HighRadius!

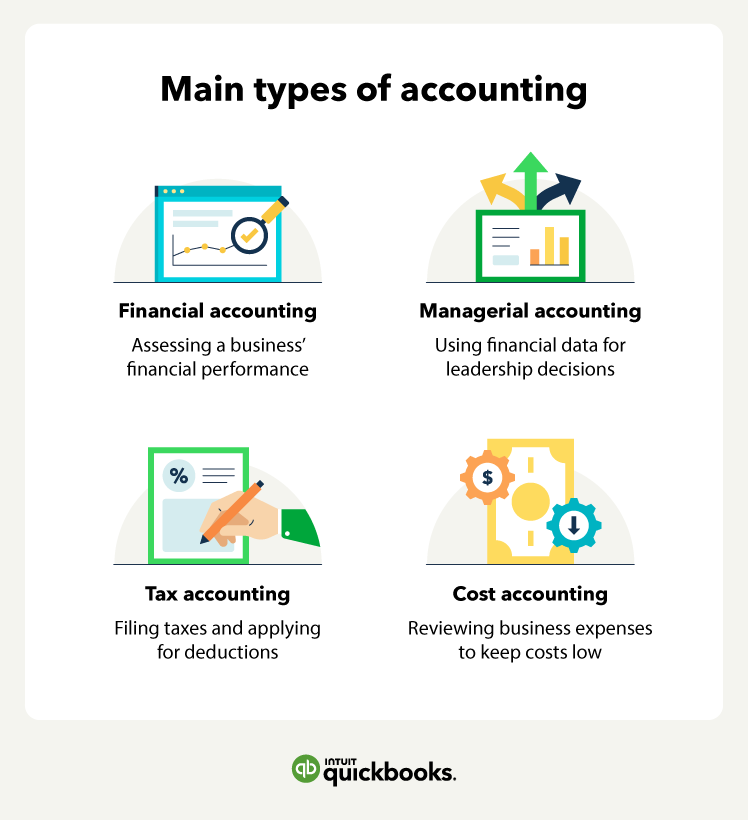

Through financial ratio analysis, financial accounting allows these parties to compare one balance sheet account with another. Standard reports like balance sheets, profit and loss statements, and cash flow statements are key. They are generated in a way to help managers analyze past decisions and plan for the future. Cost accounting is most commonly used in the manufacturing industry, an industry that has a lot of resources and costs to manage. It is a type of accounting used internally to assess a company’s operations. The two main types of financial accounting are cash accounting and accrual accounting.

- The work of a forensic accountant is interesting and challenging, and it can make a difference in the world.

- Most accounting jobs will generally require at least a bachelor’s degree in accounting or a related field.

- In the U.S., licensed CPAs must have earned their designation from the American Institute of Certified Public Accountants (AICPA).

What are the Three Main Functions of Managerial Accounting?

Accounting information exposes your company’s financial performance; it tells whether you’re making a profit or just running into losses at the end of the day. Which accounting method you should choose depends on the size of your business. On the flip side, accountants use invoicing software to help you get paid.

Forensic accounting is a growing and high-demand field because of the rise in fraud and increasing financial regulations. Tax accountants use their knowledge of tax laws and regulations to ensure that their clients comply with the law and minimize their tax liability. Tax accountants may also be involved in tax planning and advising clients on how to structure their affairs. As the accounting field continues to evolve, new types of accounting are likely to emerge to meet the ever-changing business and organization’s needs.

What is the simplest accounting software?

Still, even after learning what an accountant does, you might still wonder what accounting is at its core. Cash accounting method is ideal for small businesses which prefer a straightforward way to measure income and expenses. However, revenue won’t appear on the ledger until the payment is received. Accrual accounting is a more complex accounting method that requires you to record incoming revenue and expenses—even if payment has not been made. This means expenses are recorded once the bill is received and income for a long-term contract is recorded when the deal is closed.

An Italian mathematician and friend of Leonardo da Vinci, Pacioli published a book on the double-entry system of bookkeeping in 1494. Appropriately managing accounts receivable (AR) can have positive effects on a company’s bottom line. An accounts receivable aging report categorizes AR invoices by the length of time they have been outstanding. For example, an AR aging report may list all outstanding receivables less than 30 days, 30 to 60 days, 60 to 90 days, and 90+ days.

Like a single entry system of accounting, a cash accounting method is preferred by small businesses because it is simple to implement and saves time. Because the transaction is recorded when cash exchanges hands, the business owner has a better idea of the company’s cash flow at any given time. Accrual accounting records the dollar amounts when a transaction (a bill going out or an invoice coming in) occurs, not when the cash is actually exchanged. An accrual accounting method is required by law when a business exceeds 5 million in sales. It is believed that this method of accounting gives a more accurate picture of a company’s finances.